Understanding the Transformative Evolution of Debt Consolidation in the UK

Examining the Alarming Rise of Debt Levels in the UK

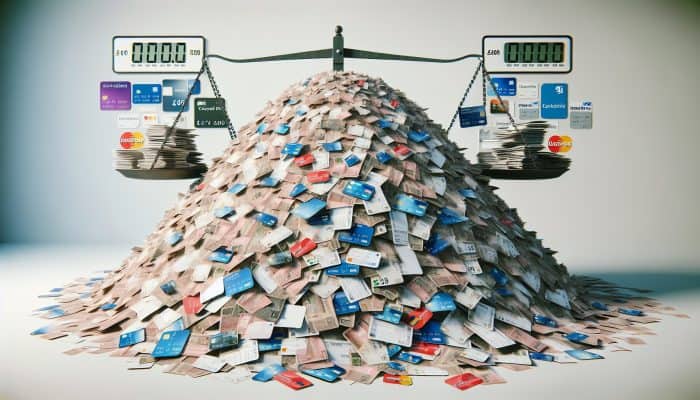

The current state of personal debt in the UK presents a troubling scenario, as numerous individuals confront substantial financial challenges. By 2023, the total household debt in the UK exceeded an astonishing £1.7 trillion, with a significant portion resulting from credit card debt, personal loans, and various other borrowing channels. The increasing pattern of consumer debt has led to a heightened dependence on debt consolidation loans, which are becoming essential for efficiently managing multiple financial commitments in a more organized way.

Many individuals are experiencing the overwhelming pressure of juggling multiple monthly payments, soaring interest rates, and escalating financial stress, which can negatively impact their mental health and physical well-being. Debt consolidation loans offer a practical solution by enabling borrowers to combine several debts into one manageable loan, often at a lower interest rate. This rising trend not only mirrors existing economic conditions but also reflects a growing awareness among consumers about the need for effective financial management.

Beyond the general debt statistics, the increasing adoption of debt consolidation loans merits further investigation. Recent research indicates that nearly 38% of adults in the UK have contemplated or utilized a debt consolidation loan, highlighting its significant role in the contemporary financial landscape. This trend illustrates a shift in consumer behavior, as individuals seek to regain control over their finances by using these loans to simplify their repayment processes.

Investigating Diverse Types of Debt Consolidation Loan Solutions

The financial landscape in the UK offers a wide range of debt consolidation loans designed to cater to the varied needs of consumers. Key options include secured loans, unsecured loans, and balance transfer credit cards. Typically, secured loans require collateral—often in the form of real estate—which can result in lower interest rates, making them appealing for larger debt amounts. In contrast, unsecured loans do not necessitate collateral, presenting a higher risk for lenders and typically attracting elevated interest rates.

Another widely used alternative is balance transfer credit cards, allowing borrowers to transfer existing debt from high-interest credit cards to a new card offering a lower or even zero introductory interest rate. While this can serve as a beneficial short-term strategy, consumers must be mindful of potential fees and the eventual return to higher interest rates once the introductory period concludes.

Moreover, the emergence of peer-to-peer lending platforms has introduced a groundbreaking alternative that connects borrowers directly with investors willing to fund their loans. This model often results in more competitive rates and flexible repayment terms, as it bypasses traditional banking intermediaries. These options signify a substantial shift in the market, catering to consumers who are in search of flexibility and affordability in their debt management strategies.

Identifying Consumer Preferences in Debt Consolidation Solutions

As consumers in the UK navigate the complex realm of debt consolidation, distinct preferences arise that significantly affect their decisions. Primarily, borrowers are attracted to loans with reduced interest rates, which often serve as the most crucial factor in their decision-making process. A recent survey unveiled that 62% of participants regarded interest rates as the most essential consideration when selecting a debt consolidation option, emphasizing the importance for lenders to maintain competitive offerings in this domain.

In addition to interest rates, consumers place a high value on transparency and reliability in loan agreements. Many borrowers express a strong desire for straightforward terms and conditions, as complexity can lead to confusion and mistrust. This demand for clarity has prompted lenders to enhance their offerings and improve customer communication, ensuring that all relevant information is readily accessible.

Customer support plays a significant role in shaping consumer preferences as well. As individuals navigate the often intricate landscape of debt consolidation, they appreciate prompt and knowledgeable customer service from lenders. A positive customer experience can greatly influence overall satisfaction and increase the likelihood of recommending certain services to others.

Finally, the increasing trend towards online services cannot be overlooked. With the convenience of online applications, many consumers now prefer digital options for managing their debt consolidation loans. This shift reflects a broader movement towards digital banking in the UK, as users seek both efficiency and accessibility in financial products.

The Technological Revolution in Loan Processing

Revolutionizing Debt Consolidation with Streamlined Online Application Systems

The emergence of online application systems has fundamentally transformed how UK consumers access debt consolidation loans, introducing a streamlined process that starkly contrasts with traditional methods. These digital platforms enable borrowers to apply for loans from the comfort of their homes, drastically minimizing the time spent on paperwork and in-branch visits. Consequently, many consumers find the online application process not only convenient but also expedited, allowing them to receive decisions in mere minutes rather than days.

However, the shift to online applications is not without challenges. Concerns regarding data privacy and the potential for fraud are increasingly prevalent. While lenders implement various security measures to protect consumer data, borrowers also bear the responsibility of ensuring they engage with reputable platforms. This shared responsibility highlights the critical importance of consumer education on safe online practices.

Furthermore, the digital landscape encourages heightened competition among lenders, resulting in more favorable terms for borrowers. With a multitude of options readily accessible, consumers can easily compare interest rates, fees, and overall loan conditions. This enhanced transparency facilitates more informed decision-making, but it also necessitates that consumers remain vigilant and discerning in their choices.

The future of debt consolidation loans is poised to witness further advancements in online application systems, including improved user interfaces and sophisticated data analytics that enable quicker and more accurate lending decisions. As technology continues to evolve, lenders must adapt to meet the expectations of a tech-savvy populace seeking efficiency and convenience in their financial dealings.

Utilizing AI and Machine Learning to Enhance Lending Practices

Artificial intelligence (AI) and machine learning are set to profoundly impact the future of debt consolidation loans in the UK. These technologies are revolutionizing how lenders assess creditworthiness and tailor loan offers to align with individual borrower needs. By analyzing extensive datasets, AI algorithms can identify patterns and trends that human analysts might overlook, leading to more informed lending decisions.

One of the most significant advantages of AI in the lending process is its ability to provide rapid assessments of borrowers. Traditional credit scoring methodologies can be slow and cumbersome, often resulting in prolonged waiting periods for approval. AI-driven models can evaluate applications in real-time, resulting in quicker turnaround times and enhanced customer satisfaction. This expedited process is particularly vital for borrowers who may need immediate funds to manage their debts effectively.

Moreover, AI can assist lenders in personalizing loan offers based on an individual’s unique financial history and circumstances. This level of customization can lead to better outcomes for borrowers, as they receive offers that align more closely with their financial situations. Such tailored approaches foster a more consumer-centric lending environment, resonating well with UK borrowers who seek meaningful financial solutions.

Nonetheless, the integration of AI raises significant ethical considerations. Issues surrounding data privacy and algorithmic bias must be addressed to ensure that these technologies promote fairness and accessibility in lending. As the industry progresses, it is essential for lenders to maintain transparency and accountability in their use of AI, thereby fostering trust among consumers.

Prioritizing Cybersecurity in the Loan Application Process

In today’s increasingly digital environment, protecting financial data during the loan application process is of paramount importance. As UK borrowers transition toward online platforms for debt consolidation loans, the necessity for robust cybersecurity measures cannot be overstated. Lenders must prioritize safeguarding sensitive information by implementing advanced security protocols to prevent data breaches and cyberattacks.

One primary security measure utilized by lenders involves encryption technology, which secures data transmitted between the borrower and the lender during the application process. By encrypting sensitive information, lenders can significantly reduce the risk of interception by malicious entities, ensuring that personal data remains confidential and secure. Additionally, multi-factor authentication has become standard practice, adding an extra layer of protection by requiring borrowers to verify their identity through multiple methods before accessing accounts or submitting applications.

Consumer awareness is equally crucial in enhancing digital security. Many borrowers may not fully understand the potential risks associated with online lending, making it essential for lenders to educate their clients on best practices for protecting their financial information. This includes using strong passwords, regularly updating security settings, and remaining vigilant against phishing attempts.

As the landscape of cyber threats continues to evolve, adopting a proactive approach to cybersecurity will be vital for lenders seeking to maintain consumer trust and ensure the integrity of their services. The future of debt consolidation will demand an unwavering commitment to safeguarding borrowers’ data, as consumers increasingly expect robust security measures in their financial transactions.

Understanding Regulatory Changes and Their Implications

Comprehending New Legislation Shaping Debt Consolidation Practices

The UK debt consolidation landscape is continually influenced by regulatory changes designed to protect consumers and enhance the overall integrity of the financial system. Recent legislation has introduced measures aimed at providing greater transparency and accountability in lending practices, thereby reshaping how debt consolidation loans are offered and managed.

A significant piece of legislation is the Consumer Credit Act, which regulates the provision of consumer credit in the UK. Recent amendments have tightened regulations surrounding advertising and marketing practices, ensuring that lenders present clear and accurate information regarding loan terms, fees, and interest rates. This enhanced transparency aims to empower consumers, enabling them to make more informed financial decisions when considering debt consolidation options.

Additionally, the introduction of the Open Banking initiative is transforming the regulatory framework surrounding debt consolidation loans. By allowing consumers to securely share their financial data with third-party providers, Open Banking encourages innovation and competition in the market. It opens new avenues for lenders to offer more tailored products, ultimately benefiting consumers who are seeking personalized debt consolidation solutions.

However, the evolving regulatory landscape also presents challenges for lenders. Complying with new regulations may necessitate significant adjustments to internal processes, potentially impacting operational efficiency and effectiveness. Financial institutions must remain agile and responsive to these changes, striving to balance compliance requirements with the demand for competitive offerings.

Overall, the effects of regulatory changes on debt consolidation loans are profound, as they aim to protect consumers while fostering a competitive lending environment. The industry’s future will hinge on lenders’ ability to adapt to these changes while continuing to meet the needs of borrowers.

Decoding FCA Guidelines in Debt Consolidation

The Financial Conduct Authority (FCA) plays a crucial role in shaping the UK’s debt consolidation market through its regulatory framework. As the primary financial regulator, the FCA establishes guidelines that govern lending practices, ensuring that consumers are treated fairly and transparently. These regulations are particularly significant in the context of debt consolidation loans, where borrowers may be vulnerable to misleading practices.

A fundamental aspect of the FCA’s guidelines is the emphasis on responsible lending. Lenders are required to conduct thorough assessments of borrowers’ financial situations before approving loans, ensuring that individuals are not overwhelmed by debt. This requirement helps safeguard consumers from falling into a cycle of debt that can lead to serious financial distress.

Furthermore, the FCA has implemented rules regarding advertising and promotional practices related to debt consolidation loans. These regulations demand that lenders provide clear and comprehensive information about the terms of their loans, including interest rates, fees, and repayment schedules. By enforcing these standards, the FCA aims to promote transparency and prevent misleading claims that could mislead borrowers.

The ongoing dialogue between the FCA and industry stakeholders is essential for refining regulations to adapt to the changing financial landscape. As new trends and technologies emerge, the FCA must remain vigilant in assessing their implications for consumers. This dynamic regulatory environment will significantly shape the future of debt consolidation loans in the UK, ensuring that borrowers’ interests are protected.

Strengthening Consumer Protection in Debt Consolidation

Consumer protection measures in the UK debt consolidation market are vital for preventing predatory lending practices from exploiting vulnerable individuals. Various organizations, including the FCA and the Consumer Financial Protection Bureau (CFPB), have established protocols to shield consumers from unfair treatment.

A primary mechanism for protecting consumers involves requiring lenders to provide clear loan agreements that outline all terms and conditions. These agreements must detail interest rates, fees, and repayment obligations, enabling borrowers to fully understand their commitments before entering into a loan agreement. This transparency not only empowers consumers but also fosters a culture of accountability within the lending industry.

Moreover, the establishment of independent financial advice services plays a crucial role in consumer protection. These organizations assist individuals considering debt consolidation, enabling them to explore their options and select appropriate solutions tailored to their specific financial situations. By providing access to unbiased information, these services empower borrowers to make informed decisions that align with their long-term financial objectives.

Additionally, enforcing strict penalties for lenders engaging in unethical practices serves as a deterrent against predatory lending. Regulatory bodies closely monitor the market, ensuring that any violations are swiftly addressed. This oversight is essential in maintaining a fair and competitive environment for both consumers and lenders.

As the debt consolidation landscape continues to evolve, consumer protection will remain a paramount concern. The industry’s future depends on the commitment of regulatory bodies and lenders to uphold ethical standards, ensuring that borrowers can access debt consolidation solutions without fear of exploitation or unfair treatment.

Investigating Economic Factors Impacting Debt Consolidation

Assessing the Influence of Interest Rates on Debt Consolidation Loans

Interest rates play an integral role in determining the appeal of debt consolidation loans, serving as a critical consideration for consumers assessing their options. In recent years, fluctuations in UK interest rates have created a complex landscape for borrowers. When interest rates are low, the attractiveness of debt consolidation loans increases, as individuals can secure loans under more favorable terms, enabling them to efficiently pay off higher-interest debts.

The Bank of England significantly impacts interest rates, and its recent monetary policy decisions have affected borrowing costs across the board. With rates remaining at historically low levels, many consumers have turned to debt consolidation loans as a financial strategy to alleviate their burdens. This trend highlights a broader economic phenomenon in which low borrowing costs stimulate consumer spending, thus promoting economic growth.

Conversely, rising interest rates can render borrowing prohibitively expensive for many consumers. Increased rates may deter individuals from pursuing debt consolidation, as potential savings diminish. This creates a challenging environment for lenders, who must adjust their offerings to remain appealing to borrowers facing heightened financial pressures.

Moreover, consumers must also consider the long-term implications of their borrowing decisions. A thorough understanding of how interest rates affect total repayment costs is crucial for anyone contemplating debt consolidation options. Borrowers who are well-informed about economic trends can make strategic choices that align with their financial objectives.

The future of debt consolidation loans will likely continue to be influenced by interest rate fluctuations, necessitating that both consumers and lenders remain vigilant in monitoring economic indicators. As consumers traverse this landscape, securing low-interest loans will remain a critical aspect of their financial well-being.

Examining Employment Trends and Their Influence on Debt Management

Employment rates are closely linked to individuals’ financial stability and, consequently, their ability to manage debt. As the UK labor market emerges from economic challenges, strong employment figures have instilled renewed confidence among consumers regarding their financial prospects. Higher employment rates typically lead to increased disposable income, allowing individuals to view debt consolidation loans as a viable means of managing existing debts.

When job security is robust, consumers are more inclined to engage in proactive financial planning, including consolidating debts to streamline their repayment processes. Many individuals consider debt consolidation as a strategic move to regain control over their financial situations, particularly when their income levels are stable. This can create a positive feedback loop, where enhanced financial stability fosters increased economic activity.

Conversely, periods of economic downturn and rising unemployment can pose significant challenges for prospective borrowers. Job loss or instability can lead to hesitation in pursuing debt consolidation, as individuals may fear incurring additional financial obligations amid uncertainty. In such circumstances, lenders must adapt their offerings to accommodate consumers’ changing needs, potentially by providing tailored solutions that reflect the current economic climate.

The interplay between employment rates and debt consolidation will continue to shape the financial landscape. As the job market evolves, both consumers and lenders must stay attuned to shifts in employment trends to ensure informed decisions regarding debt management strategies.

Understanding the Effects of Inflation on Debt Consolidation Choices

Inflation significantly impacts the economic environment, with its effects particularly evident in the realm of debt consolidation loans. As the prices of goods and services rise, consumers may find their budgets increasingly strained, resulting in greater reliance on credit to meet everyday expenses. This scenario can lead to a precarious cycle where individuals accumulate debt faster than they can manage, prompting many to consider debt consolidation as a viable solution.

In an inflationary context, the real value of debt can decrease, making debt consolidation loans more appealing. Borrowers may discover that combining multiple debts into a single loan allows them to secure lower interest rates, thereby protecting themselves against potential future increases in borrowing costs. This strategy can be particularly advantageous during periods of high inflation, offering a structured approach to managing financial obligations.

However, rising inflation also influences the lending landscape, as lenders may respond by adjusting their interest rates to mitigate risk. Increased borrowing costs can discourage consumers from pursuing debt consolidation, especially if they feel that potential benefits do not outweigh the associated expenses. This dynamic underscores the importance of meticulous financial planning when navigating inflationary periods, as consumers must carefully evaluate their options with a comprehensive understanding of the broader economic context.

As the UK grapples with inflationary pressures, the future of debt consolidation loans will be closely linked to economic conditions. Both consumers and lenders must remain adaptable, leveraging financial tools that align with the current economic landscape to facilitate sustainable debt management.

Analyzing Market Competition and Loan Offerings

Leading Players in the UK Debt Consolidation Market

The UK debt consolidation market features a diverse array of lenders competing for consumer interest. Major financial institutions, including high street banks and alternative lenders, provide various loan products designed to assist individuals in effectively consolidating their debts. Among the most prominent players are established banks like Lloyds, Barclays, and HSBC, which offer both secured and unsecured debt consolidation loans tailored to meet the needs of a wide range of borrowers.

In addition to traditional banks, peer-to-peer lending platforms have gained traction, presenting a novel approach to debt consolidation. Companies like RateSetter and Funding Circle connect borrowers directly with individual investors, eliminating the need for conventional banking intermediaries. This innovative model often results in competitive interest rates and flexible repayment terms, appealing to consumers in search of more personalized lending experiences.

Furthermore, online-only lenders have emerged as formidable competitors in the debt consolidation sector. These digital-first companies, such as Zopa and Revolut, offer streamlined application processes and rapid decision-making, attracting tech-savvy consumers who prioritize convenience. The competition fostered by this diverse array of lenders has led to a more dynamic market, providing consumers with options tailored to their unique financial circumstances.

As borrowers become increasingly discerning in their choices, the emphasis on customer service and satisfaction has intensified. Lenders must focus on building strong relationships with their clients, offering personalized support and guidance throughout the loan process. This competitive environment encourages innovation and improvement, ultimately benefiting consumers seeking effective debt consolidation solutions.

Understanding Competitive Interest Rates in Debt Consolidation

In the competitive realm of debt consolidation loans, interest rates are a crucial factor in attracting borrowers. With numerous lenders vying for consumer attention, interest rates have become a prominent differentiator in the decision-making process. As of late 2023, the average interest rates for debt consolidation loans in the UK range from 3% to 7%, influenced by various factors, including creditworthiness and loan amounts.

This competitive environment encourages lenders to offer appealing rates to stand out, prompting consumers to shop around for the best deals. Borrowers who invest time in comparing interest rates across different lenders can secure substantial savings over the life of their loans, underscoring the importance of thorough research in the debt consolidation process.

Moreover, the trend toward transparency in lending practices means that consumers can easily access information regarding current interest rates and lending terms. Online comparison tools and platforms have streamlined the process for borrowers to evaluate their options, fostering a well-informed consumer base. This shift toward informed decision-making empowers individuals to uncover the most competitive rates that align with their financial situations.

Lenders who consistently offer lower interest rates while maintaining high service standards are likely to experience enhanced customer loyalty and retention. As the market evolves, a strong focus on competitive interest rates will remain essential for lenders aiming to thrive in the ever-changing financial landscape.

Innovative Loan Products for Effective Debt Consolidation

The evolution of the UK debt consolidation market has been marked by the introduction of innovative loan products that cater to the diverse needs of consumers. As borrowers seek more tailored solutions, lenders are responding with offerings that combine flexibility, convenience, and affordability. Among these innovative products are hybrid loans, which allow borrowers to consolidate various types of debt into a single loan featuring a flexible repayment structure.

The rise of technology-driven solutions has also led to the creation of mobile applications, enabling borrowers to manage their debt consolidation loans more efficiently. These apps often incorporate budgeting tools, repayment calculators, and real-time tracking, empowering consumers to stay on top of their financial commitments. By leveraging technology, lenders can enhance the overall customer experience, facilitating effective debt management.

Additionally, lenders are increasingly offering bespoke loans tailored to specific demographics, such as self-employed individuals or recent graduates. These products address the unique financial challenges faced by different borrower segments, providing a more personalized approach to debt consolidation. By recognizing the diverse needs of consumers, lenders can foster stronger relationships and build trust within the market.

As competition intensifies, innovation will continue to be a driving force in the debt consolidation landscape. Lenders that prioritize the development of creative solutions addressing consumer pain points will be well-positioned to capture market share and meet the evolving demands of borrowers.

Assessing Market Share in Debt Consolidation Loans

The competitive landscape of debt consolidation loans in the UK is characterized by a dynamic distribution of market share among major lenders. Established banks dominate a significant portion of the market, leveraging their extensive branch networks and brand recognition to attract borrowers. However, alternative lenders and fintech companies are steadily gaining ground, challenging the market dominance of traditional banks.

Recent analyses indicate that traditional banks hold approximately 60% of the debt consolidation loan market share, while alternative lenders and peer-to-peer platforms account for around 25%. The remaining 15% is attributed to newer entrants in the fintech space, which continue to carve out their niches by offering innovative products and services tailored to the needs of modern borrowers.

As competition intensifies, market dynamics are shifting, leading lenders to focus increasingly on customer-centric strategies. This includes enhancing customer service, simplifying application processes, and providing more flexible repayment options. Such initiatives have the potential to influence market share, as consumers gravitate toward lenders that deliver a positive borrowing experience.

Moreover, the growth of online platforms has facilitated easier access for borrowers to a wider range of loan options. The ability to rapidly compare rates and terms across multiple lenders empowers consumers to make informed choices, fostering a more competitive environment that ultimately benefits borrowers.

As the debt consolidation market continues to evolve, understanding the dynamics of market share will be crucial for lenders aiming to position themselves effectively. By adapting to changing consumer preferences and leveraging technological advancements, lenders can navigate the market’s complexities and maintain a competitive edge.

Enhancing Customer Satisfaction Through Consumer Feedback

In the realm of debt consolidation loans, customer satisfaction is vital, with service quality significantly influencing a lender’s reputation and market success. Borrowers increasingly rely on online reviews and ratings to assess the experiences of others when selecting a lender, making consumer feedback a powerful tool in the decision-making process.

Research indicates that over 70% of potential borrowers read reviews before choosing a lender, underscoring the importance of maintaining a positive online presence. Lenders that prioritize customer satisfaction and actively seek feedback are more likely to build trust with potential borrowers, ultimately affecting their conversion rates.

Furthermore, studies reveal that borrowers who have positive experiences with their lenders are more inclined to recommend their services to friends and family. This word-of-mouth marketing is invaluable, as personal recommendations often carry more weight than traditional advertising. Therefore, lenders must emphasize delivering exceptional service, from the initial application process through loan repayment.

To enhance customer satisfaction, many lenders invest in customer support initiatives, providing dedicated representatives to assist borrowers throughout their journeys. This personalized approach can alleviate concerns and foster rapport, ultimately building long-term loyalty. Additionally, offering educational resources and tools can empower borrowers to make informed decisions, enriching their overall experience.

As competition in the debt consolidation market intensifies, lenders must remain vigilant in monitoring customer satisfaction and responding to feedback. By prioritizing exceptional service and addressing consumer concerns, lenders can bolster their reputations and secure a competitive advantage in the ever-evolving lending landscape.

Advancing Consumer Education and Financial Literacy

The Importance of Effective Debt Management Programs

The availability and effectiveness of debt management programs in the UK play a vital role in assisting individuals grappling with financial burdens. Often provided by non-profit organizations, these programs offer comprehensive support to consumers seeking to regain control of their finances. By collaborating with financial advisors, individuals can develop personalized debt management plans that outline practical steps for consolidating and repaying their debts.

A key advantage of debt management programs is their emphasis on creating manageable repayment schedules. Financial advisors assist borrowers in evaluating their income and expenses, enabling them to craft a realistic plan tailored to their unique situations. This customized approach can alleviate the stress associated with overwhelming debts, providing individuals with a sense of direction and purpose in their financial journeys.

Moreover, many debt management programs focus on financial education, equipping borrowers with the skills and knowledge necessary for making informed decisions. Workshops and resources on topics such as budgeting, saving, and responsible borrowing empower consumers to take charge of their financial futures. Such initiatives are crucial for fostering a culture of financial literacy, which can lead to more sustainable debt management practices.

However, challenges persist in ensuring that consumers are aware of these programs’ availability. Many individuals may hesitate to seek help due to stigma or a lack of understanding about the options available. Increased awareness campaigns and outreach efforts are essential for promoting the benefits of debt management programs and encouraging individuals to seek assistance when needed.

As the financial landscape continues to evolve, the significance of debt management programs is likely to grow. By providing tailored support and education, these initiatives can empower UK borrowers to navigate their debt consolidation journeys more effectively, fostering long-term financial well-being.

Initiatives to Promote Financial Literacy

Efforts to enhance financial literacy among potential loan applicants in the UK have gained momentum in recent years. Various organizations, including non-profits and educational institutions, are working to equip consumers with the knowledge and skills needed to make informed financial decisions, particularly regarding debt consolidation.

A notable initiative is the Money Advice Service, which provides a wealth of resources aimed at enhancing financial education across the UK. Their online platform offers tools, guides, and calculators that assist individuals in better understanding their finances and making informed decisions about borrowing and debt management. This focus on accessibility ensures that a broad audience can benefit from valuable financial insights.

Additionally, many schools and universities are integrating financial literacy programs into their curricula, helping students cultivate fundamental skills from an early age. By addressing financial education during formative years, these initiatives aim to create a more financially savvy generation capable of managing challenges such as debt consolidation in adulthood.

Community workshops and seminars also play a crucial role in enhancing financial literacy. These events often bring together financial experts and consumers, facilitating open discussions about budgeting, saving, and responsible borrowing. Such initiatives are particularly effective in reaching underserved populations who may lack access to traditional financial education resources.

As the demand for financial education continues to rise, collaboration among government agencies, educational institutions, and non-profit organizations will be essential. By working together to promote financial literacy, stakeholders can empower UK consumers to make informed decisions about debt consolidation and other financial matters.

Essential Resources for Borrowers Navigating Debt Consolidation

Successfully navigating the intricacies of debt consolidation can be challenging for borrowers, which makes access to relevant resources crucial. Numerous UK-based organizations and platforms provide valuable support and information to help individuals understand their options and make informed decisions regarding debt management.

One of the most prominent resources is the National Debtline, which offers free and confidential advice to individuals facing financial difficulties. Through their helpline and online resources, borrowers can access tailored guidance on debt consolidation, budgeting, and repayment strategies, ensuring they have the necessary tools to effectively manage their financial situations.

Furthermore, various online comparison websites have emerged, enabling borrowers to evaluate different debt consolidation loan options side by side. These platforms allow consumers to compare interest rates, terms, and lender reviews, promoting informed decision-making. By streamlining the research process, these resources empower borrowers to find solutions that best suit their financial needs.

Additionally, social media and online forums have become increasingly popular venues for borrowers seeking peer support and advice. Communities dedicated to personal finance often share experiences and insights related to debt consolidation, creating a supportive environment for individuals navigating similar challenges. This exchange of information can be invaluable, fostering camaraderie and understanding among borrowers.

As the landscape of debt consolidation continues to evolve, ensuring that borrowers have access to comprehensive resources will remain crucial. By promoting awareness of available support options, stakeholders can empower UK consumers to take control of their debt management journeys.

Foreseeing Future Trends in Debt Consolidation

Highlighting Personalization in Loan Offerings

The future of debt consolidation loans in the UK is poised for transformation, with personalization emerging as a significant trend. As lenders increasingly recognize the diverse financial needs of borrowers, tailored loan products are becoming more prevalent. This shift towards personalized loans enables consumers to receive solutions that align with their circumstances and financial goals.

Technology plays a vital role in facilitating this trend, allowing lenders to leverage data analytics and AI to create customized loan offerings. By analyzing borrowers’ financial histories, spending patterns, and repayment capabilities, lenders can design loan products that cater to specific needs, such as flexible repayment terms or adjusted interest rates. This level of personalization not only enhances the borrowing experience but also increases the likelihood of successful repayment, benefiting both lenders and consumers.

Moreover, the rise of alternative lending platforms has further fueled the demand for personalized loans. These platforms often prioritize a holistic approach to assessing borrowers, considering factors beyond traditional credit scores, such as income stability and cash flow. By focusing on individual financial profiles, lenders can provide more equitable access to debt consolidation loans, fostering a more inclusive lending environment.

As the industry evolves, the emphasis on personalization is likely to lead to increased competition among lenders. Consumers will benefit from a wider variety of tailored options, allowing them to select solutions that genuinely meet their unique financial needs. This shift toward bespoke lending practices marks a significant advancement in creating a more consumer-friendly debt consolidation market.

Integrating Debt Consolidation with Holistic Financial Planning Strategies

The future of debt consolidation loans is increasingly intertwined with broader financial planning strategies. As consumers become more aware of the importance of holistic financial management, lenders are adapting their offerings to encompass comprehensive debt strategies that align with borrowers’ overall financial objectives.

This integration manifests in various ways, including the provision of financial advisory services alongside loan offerings. Lenders are beginning to recognize that merely providing a loan is insufficient; they must also equip borrowers with the tools and knowledge to manage their finances effectively. By offering financial education workshops or access to certified financial advisors, lenders can empower consumers to make informed decisions regarding their debt consolidation loans and overall financial well-being.

Furthermore, the use of digital platforms and tools is facilitating this integration. Many lenders now offer budgeting apps and financial planning resources that enable borrowers to track their spending and repayment progress. These tools not only enhance the borrowing experience but also encourage consumers to adopt proactive financial habits, fostering long-term financial health.

Moreover, as the trend toward sustainability gains traction, borrowers may increasingly seek debt consolidation solutions that align with their values. Financial institutions prioritizing ethical lending practices and environmentally responsible initiatives will likely resonate with consumers seeking a comprehensive approach to their financial well-being.

The fusion of debt consolidation loans with broader financial planning strategies signifies a shift toward a more holistic view of personal finance. As this trend continues to evolve, consumers can anticipate a more integrated financial journey, ultimately leading to healthier financial outcomes.

Ensuring Sustainable Debt Reduction Through Consolidation

The pursuit of sustainable debt reduction through consolidation will be a focal point in the UK financial landscape. As borrowers increasingly recognize the importance of long-term financial health, strategies that promote sustainable debt management are gaining traction. Rather than viewing debt consolidation as a mere temporary fix, consumers are beginning to embrace it as a pathway toward financial stability and growth.

One of the primary drivers of this trend is the growing emphasis on responsible borrowing. Consumers are becoming more aware of the long-term implications of their financial decisions, leading them to seek debt consolidation solutions that prioritize sustainable repayment structures. This shift encourages borrowers to consider not only the immediate benefits of consolidation but also the broader financial impact of their choices.

Lenders are responding by developing loan products that promote sustainable debt reduction. This includes offering flexible repayment options, interest rate discounts for consistent on-time payments, and incorporating financial education into the lending process. By aligning their products with borrowers’ long-term financial goals, lenders can foster a culture of responsible borrowing and empower consumers to take control of their financial futures.

Furthermore, the integration of technology will play a significant role in encouraging sustainable debt reduction. Digital tools and platforms that assist borrowers in tracking their spending, creating budgets, and monitoring their repayment progress will promote more mindful financial behaviors. This proactive approach to debt management not only supports borrowers in staying on track but also enhances the overall sustainability of their financial health.

As the UK financial landscape continues to evolve, the focus on sustainable debt reduction through consolidation will remain paramount. By prioritizing responsible lending practices and equipping borrowers with the tools necessary for lasting financial success, the industry can pave the way for a more secure financial future for consumers.

Technological Innovations Reshaping Debt Management Practices

The landscape of debt consolidation is poised for significant transformation due to technological advancements, reshaping how borrowers engage with their financial obligations. As digital solutions become increasingly integral to the borrowing experience, the efficiency and effectiveness of debt consolidation processes are likely to improve markedly.

One of the most noteworthy advancements is the implementation of artificial intelligence and machine learning in debt management platforms. These technologies can streamline the loan application process, allowing for quicker assessments of creditworthiness and more personalized loan offerings. By analyzing a borrower’s financial history and behavior, lenders can craft tailored solutions that address individual needs, ultimately enhancing the borrowing experience.

Moreover, the rise of mobile applications is revolutionizing how borrowers manage their debt consolidation loans. These apps typically include features such as budgeting tools, repayment reminders, and progress tracking, empowering consumers to take charge of their finances. By providing real-time insights into their financial situations, borrowers can make informed decisions and adjust their spending habits accordingly.

Additionally, the integration of blockchain technology is set to enhance transparency and security in the lending process. Smart contracts can automate key aspects of loan agreements, ensuring compliance and reducing the risk of fraud. This innovation fosters a more trustworthy lending environment, promoting confidence among borrowers as they navigate the complexities of debt consolidation.

As technology continues to advance, the future of debt consolidation is likely to witness even more transformative solutions emerge. Lenders that embrace these innovations and prioritize user-friendly experiences will be well-positioned to meet the evolving demands of consumers. The intersection of technology and debt management represents a significant opportunity for the industry to enhance financial accessibility and empower borrowers on their financial journeys.

Showcasing Notable Case Studies and Success Stories

Inspiring Real-Life Triumphs in Debt Consolidation

While a comprehensive overview of the future of debt consolidation loans outlines the theoretical framework, individual success stories provide tangible evidence of how these financial products can transform lives. Numerous residents in the UK have effectively navigated their debt challenges through consolidation, offering inspiration and hope for others facing similar circumstances.

Consider the case of Sarah, a marketing professional based in London who found herself overwhelmed by multiple credit card debts with high interest rates. After exploring her options, she sought a debt consolidation loan to simplify her repayments. By securing a loan with a lower interest rate, Sarah was able to eliminate her existing debts, consolidating them into a single monthly payment. This not only alleviated her financial stress but also enabled her to redirect her resources toward savings and investments, ultimately improving her financial well-being.

Similarly, John, a single father from Manchester, faced mounting pressures from various personal loans and credit commitments. Recognizing the need for a strategic approach, he sought out a debt consolidation loan tailored to his situation. Through a peer-to-peer lending platform, John secured a loan with favorable terms that helped him clear his existing debts. The reduced monthly payment allowed him to allocate funds towards his children’s education, illustrating how debt consolidation can facilitate broader financial objectives.

These success stories underscore the potential of debt consolidation loans to empower individuals to take charge of their financial destinies. As more consumers share their experiences, the narrative surrounding debt consolidation evolves from being merely a financial tool to becoming a pathway toward improved financial stability and security.

Addressing Common Questions About Debt Consolidation Loans

What exactly are debt consolidation loans?

Debt consolidation loans are financial products that enable borrowers to merge multiple debts into a single loan, typically featuring a lower interest rate and a fixed repayment schedule.

Who stands to benefit from debt consolidation loans?

Individuals with several outstanding debts, such as credit cards or personal loans, can benefit from debt consolidation loans by simplifying their repayments and potentially lowering their overall interest costs.

Are debt consolidation loans accessible to individuals with poor credit?

Yes, some lenders offer debt consolidation loans to individuals with poor credit, although interest rates may be higher. Secured loans can also be an option for those with lower credit scores.

How can I choose the right lender for a debt consolidation loan?

When selecting a lender, consider factors such as interest rates, fees, customer service, and online reviews. Comparing various options can help you find the best deal that suits your needs.

What risks are associated with debt consolidation loans?

Risks include potentially incurring additional debt if not careful, high interest rates for borrowers with poor credit, and the possibility of losing collateral if a loan is secured against assets.

How long does it typically take to obtain a debt consolidation loan?

The timeline for securing a debt consolidation loan varies by lender; however, many online applications can yield decisions within minutes, while funding may take several days.

Can I consolidate both secured and unsecured debts?

Generally, it is possible to consolidate both secured and unsecured debts; however, the type of consolidation loan must be appropriate for the debts being consolidated.

Will debt consolidation impact my credit score?

Debt consolidation may cause a temporary dip in your credit score due to the hard credit inquiry, but it often improves your score in the long term by reducing your total debt burden.

How can I increase my chances of approval for a debt consolidation loan?

To enhance your chances of approval, maintain a good credit score, provide proof of stable income, and ensure that accurate and complete information is included in your application.

Are there alternatives to debt consolidation loans?

Yes, alternatives include debt management plans, balance transfer credit cards, and consulting with a financial advisor for personalized solutions that suit your circumstances.

Engage with us on Facebook!

This article was initially published on: https://www.debtconsolidationloans.co.uk

The Article Debt Consolidation Loans: Trends and Future Predictions Was Found On https://limitsofstrategy.com